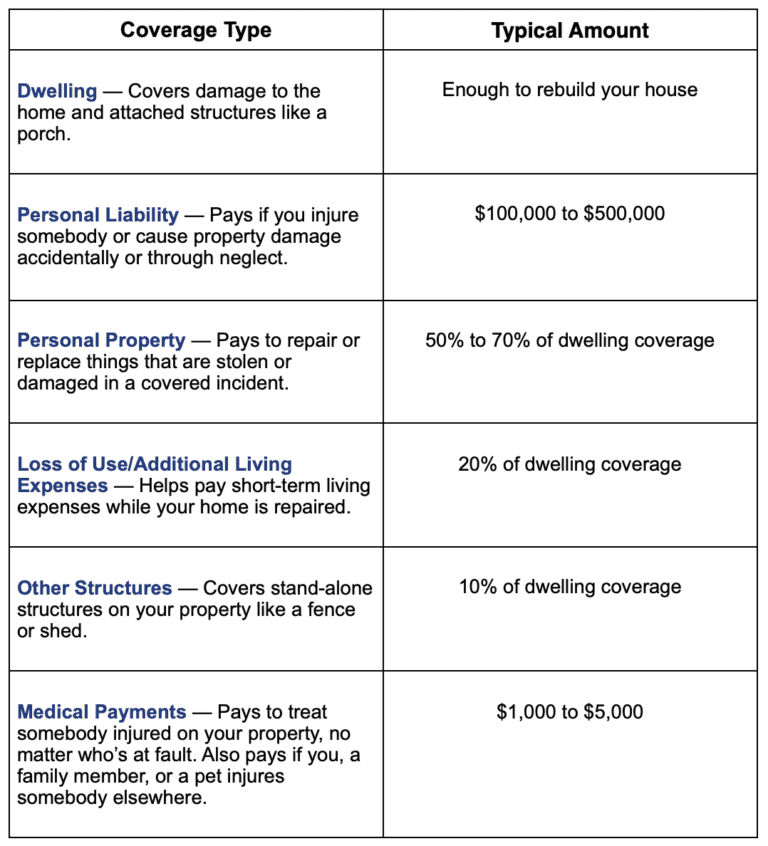

Flood Insurance Policy Failing to maintain flooding insurance coverage-- for both renters and house owners-- can cause the rejection of future federal catastrophe assistance. If the building is not in a risky location, yet rather in a modest- to low-risk location, government law does not require flood insurance, nevertheless, a lending institution can still require it. As a matter of fact, over 20 percent of all flooding insurance policy claims come from locations outside click here of mapped high-risk disaster area. The personal effects section covers food fridges freezer, washer \ dryers and window air conditioning system. Insurance coverage for most other personal effects in cellars is omitted from flooding plans. To read more regarding what is covered and what is not, review the NFIP's recap of coverage or read your insurance policy. A sump pump may assist reduce the danger of water damage from taking place in your basement. Some property owners insurance companies supply a different recommendation for discharge or overflow from a sump pump, which might cover the repairs to your harmed basement. While insurance policy typically does not cover flooding damage, your home owners plan may include insurance coverage for a ruptured pipe or leaking roof covering. However, you might need to defend your payment also if damages happens because of a protected occasion. Understanding your plans and which ones apply under what circumstances can make storm damage recuperation a lot easier. For example, you might need to determine which insurance provider to submit a water damages insurance case with based upon the occasion that harmed your home. We normally first consider rains and flooding when we think of water damage. A hefty rainstorm, overloaded drainage system, or various other body of water overflow can quickly trigger a flooding. Since flooding can take place at any moment (and is hard for insurance companies to anticipate) it's not functional to include it in standard home owners plans. Water damages brought on by a burst pipeline will commonly be covered by your home owners insurance coverage, so long as the discharge was unexpected and unexpected. Personal effects insurance coverage, however, typically does not extend to damages brought on by wild animals. Flooding takes place in modest- to low-risk areas along with in risky areas. Poor drain systems, quick buildup of rains, snowmelt and busted water mains can all result in flooding. Characteristic on a hill can be damaged by mudflow, a protected danger under the Standard Flood Insurance Coverage. In risky areas, there is at least a one-in-four possibility of flooding during a 30-year mortgage. For these reasons, flooding insurance policy is needed by legislation for structures in high-risk flooding locations as a condition of receiving a home mortgage from a federally regulated or guaranteed lending institution. Added living expenses are limited under the majority of policies and only cover amounts beyond your normal living expenditures. Requirement house owners policies do cover some sorts of unexpected and unintended water damage and/or mold and mildew, including ruptured pipelines, and in some cases sewer back up or sump pump failure if you have that protection. Nevertheless, even if your plan covers these types of water damage, some companies have actually begun to specifically leave out or restrict insurance coverage for mold that results.

Most Homeowner's Insurance Provider Do Not Cover Water Damage From Storms Or Floods

Her job has actually also shown up in Organization Expert, Money, HerMoney, PayScale, and The Muse. Nevertheless, an act of criminal damage would certainly not be covered if your home has actually been vacant for 60 days or more, unless you've https://privatebin.net/?1fc6f0e86b74e942#9ai264Gyat5Cxf2CsLVt12WTth7vJ9Jj6HwNqvGbLFEN included a vacant home recommendation to your policy. If you are worried about feasible health risks from mold growth in your home, you need to seek advice from a doctor. If mold development is energetic, considerable, and persistent, it has the potential to trigger health problems, one of the most common of which are allergies such as hissing, sneezing, coughing, eye inflammation, etc.- Tips for suing after a loss can be discovered on our major Disaster & Flood Resource Center.Mold and mildews require water or dampness to expand, however not all sources of water damages are covered by home owners insurance plan.Most flood insurance plan have a 30-day waiting period, so don't wait up until a storm is on the horizon to safeguard insurance coverage.Water damages can create significant injury to your home, swiftly totaling hundreds of dollars in damage and needing months of restoration.Though a Michigan home insurance policy claims lawyer can assist you appeal a decision if your insurance claim is refuted, it's practical to recognize the usual kinds of tornado damage most plans cover.

Does House Owners Insurance Cover A Burst Pipe?

Why is flood insurance coverage not included in a conventional property owners insurance plan?

The main factor flooding insurance coverage is not consisted of in typical home insurance policy is the essentially various danger evaluation. Flooding is a local occasion that can cause considerable damage to homes in specific areas while saving others.